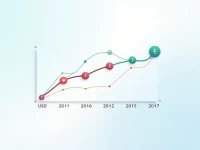

Canadian Dollar Dips Against USD Amid Market Volatility

This article analyzes the recent movements of the USD/CAD exchange rate and the influencing factors, including interest rate differentials, economic data, commodity prices, and geopolitical risks. It also outlines the performance of other major currency pairs and the interest rate policies of major central banks. Furthermore, it forecasts the future trend of the USD/CAD exchange rate, emphasizing the need for investors to closely monitor the global economic situation and central bank policy developments.